The Spectacular Implosion of Project Titan

For a decade, Apple’s secretive car initiative, Project Titan, loomed over the automotive industry like a phantom; whispered about in boardrooms, speculated on by analysts, and feared by legacy automakers.

Then, in early 2024, it vanished.

Not with a revolutionary product unveiling, but with a quiet corporate memo announcing the project’s shutdown and the reassignment of 2,000 employees.

Born in around 2014, Apple’s Project Titan (its long-rumored electric and autonomous vehicle initiative) was shrouded in secrecy and frequently shifted direction—from building a fully autonomous vehicle to focusing on EV software and back again.

Multiple sources like Bloomberg and TechCrunch confirmed Apple officially shut down the project in February 2024. The announcement was made internally during a brief meeting led by Apple COO Jeff Williams and VP Kevin Lynch.

The decision affected nearly 2,000 employees, many of whom were reassigned to Apple’s growing artificial intelligence division, while others got laid off.

Apple’s failure to enter the car market wasn’t due to a lack of resources—the company sat on approximately $150 billion in cash reserves—but rather a fundamental misunderstanding of what it takes to manufacture vehicles at scale.

As of the most recent data from March 31, 2025, Apple reported $48.5 billion in cash and short-term investments — a significant decline from previous years.

The demise of Project Titan reveals a harsh truth: Tech companies routinely underestimate the automotive industry.

This isn’t just an Apple problem. Sony’s cautious partnership with Honda, Google’s abandoned self-driving car prototypes, and even Amazon’s struggles with Rivian all point to the same conclusion: Silicon Valley doesn’t know how to build cars.

The Lowdown

While Apple never officially confirmed many details, investigative reports and insider accounts have painted a vivid picture of what went wrong.

Apple envisioned a revolutionary electric, autonomous vehicle. At its peak, the team swelled to over 5,000 employees, including top talent from Tesla, Mercedes-Benz, and NASA.

Apple reportedly spent over $10 billion on the project.

The project was repeatedly rebooted. Apple couldn’t settle on whether to build a full car, just the self-driving software, or something in between.

One early prototype was a steering wheel–less minivan controlled by Siri — a concept that was quickly scrapped. Later designs included a pod-shaped vehicle with gull-wing doors and no front or rear — just side windows.

Leadership changed hands multiple times, from Steve Zadesky to Bob Mansfield to Doug Field and Kevin Lynch. Each brought a new vision, often clashing with Apple’s famously secretive and perfectionist culture.

Jony Ive, Apple’s former design chief, reportedly pushed for a fully autonomous vehicle with no steering wheel, while others wanted a more traditional EV.

Apple held talks with Tesla, BMW, McLaren, Mercedes-Benz, and Hyundai/Kia, but none materialized into a manufacturing partnership. A brief collaboration with Volkswagen to build employee shuttles was also abandoned.

By 2022, Apple had abandoned full autonomy and scaled back ambitions. In February 2024, the company officially shut down Project Titan, reassigning many of the 2,000 employees to its AI division.

Ultimately, you can hang the project’s demise on indecision, shifting goals, and the brutal economics of the auto industry — where margins are thin and execution is unforgiving.

Apple tried to reinvent the car the way it reinvented the phone — but the road proved far bumpier than expected.

The Three Fatal Mistakes Tech Giants Make In Automotive

1. The "Just Another Gadget" Fallacy

Tech companies are used to disrupting industries with sleek software and rapid iteration. Cars, however, are not iPhones on wheels.

Apple reportedly approached Project Titan with the same mindset that made its consumer electronics dominant:

- Over-reliance on suppliers (expecting Magna or Foxconn to handle manufacturing like they do for iPhones).

- Underestimating regulatory hurdles (safety certifications, crash testing, and emissions compliance).

- Assuming software could compensate for hardware shortcomings (Tesla learned this the hard way with early Model 3 production).

The result of these mistakes is a product that never left the lab. Apple cycled through multiple concepts, from a fully autonomous pod to a luxury EV, but never settled on a viable path to production.

2. The Cost Of Ignoring Legacy Auto Expertise

While Apple debated whether its car should have a steering wheel, Toyota was refining its battery supply chain and Volkswagen was investing $100 billion in EV platforms.

Legacy automakers have spent a century mastering supply chain logistics (securing lithium, steel, and semiconductors at scale), factory efficiency (Toyota’s production system is still the gold standard), dealer networks, and service infrastructure (something Tesla still struggles with).

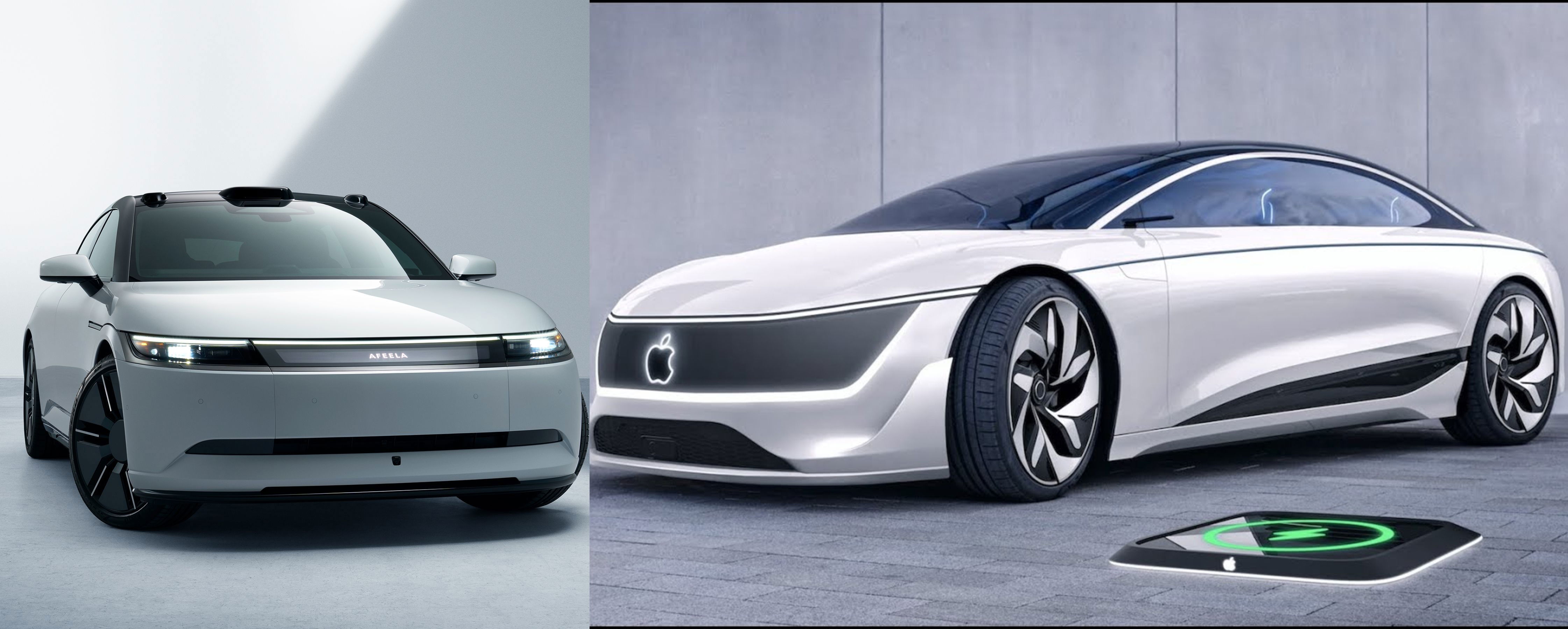

Sony, to its credit, recognized this early. Rather than going solo, it partnered with Honda to build the Afeela EV, letting Honda handle manufacturing while Sony focused on sensors and software.

3. The Profitability Paradox

Tech companies expect iPhone-level margins (40%+). Cars, even premium EVs, rarely break 10%. Tesla’s gross margins have hovered around 18-22%—and only after years of brutal cost-cutting. Lucid and Rivian are still losing tens of thousands per vehicle. Traditional automakers like Ford and GM often make more profit from financing than from selling cars.

Apple reportedly wanted to price its car above $100,000 to maintain margins. But in a market where even Porsche is struggling to sell $150,000 Taycans, that strategy was doomed.

The Sony-Honda Model: A Blueprint For Tech’s Auto Future?

While Apple stumbled through its ambitious yet ultimately doomed car project, Sony and Honda moved with quiet, calculated precision. Together, they forged a partnership that played to each company’s strengths with the development of their Afeela EV.

Honda took charge of building the car, drawing on its decades of manufacturing experience, proven safety standards, and robust global supply chains. Meanwhile, Sony delivered the brains and soul of the vehicle—cutting-edge imaging sensors, sophisticated AI systems, and immersive entertainment platforms.

Unlike Apple’s solitary and secretive endeavor, Sony and Honda chose collaboration, sharing the financial and technical load so neither partner had to shoulder the full weight alone. It was a strategy grounded in pragmatism and mutual trust, one that just might give them the edge where others faltered.

This "asset-light" model may be the only viable path for tech firms in automotive.

Why It Works:

It works because it’s refreshingly sensible in a space where ambition often overshadows execution. By teaming up with Honda, Sony avoids the crushing capital costs and complexities of building car factories from scratch. There’s no need to reinvent production pipelines or train a new workforce. Honda already has a global infrastructure that turns out millions of cars with precision.

Then there’s the distribution puzzle, something that has tripped up many EV startups. Here, too, Sony sidesteps the trap: Honda’s established dealer network does the heavy lifting, getting cars into showrooms and onto streets without the friction of building a retail operation from the ground up.

And when it comes to the often-murky world of automotive regulation, Honda’s decades of crash-testing and compliance experience mean the Afeela EV doesn’t get bogged down in red tape. It glides toward certification on a path already paved smooth by expertise. Pragmatic, efficient, and quietly brilliant.

What This Means For The Future Of Tech In Auto

The End of the “We’ll Do It All” Fantasy

Tech giants thought they could disrupt auto the way they did phones and browsers—by going full-stack. But building cars isn’t like shipping code.

Google’s Firefly pod was cute and visionary, but it stalled under the weight of regulatory hurdles and manufacturing inexperience. Amazon’s investment in Rivian showcased the promise of electrified fleets, yet scaling production has proven far messier than expected. The lesson? Let the coders code and let the carmakers weld. Collaboration is the new disruption.

The Rise of Auto-aaS (Automotive as a Service)

Instead of forging their own chassis, tech companies are embedding themselves deep inside the dashboard.

Google’s Android Automotive now powers infotainment systems from Volvo to GM. Nvidia’s chips run next-gen ADAS (advanced driver-assistance systems). And Amazon’s Alexa Auto gives voice to the connected car.

Foxconn’s push for a white-label EV platform, even positioning itself as the “Android of EVs”, suggests a tectonic shift: cars as configurable tech ecosystems, not proprietary silos. It’s like SaaS for sedans.

The Consolidation Reality Check

The EV gold rush is turning into a grind. With razor-thin margins and brutal capital needs, the field is narrowing fast.

Companies like Fisker and Lordstown have flirted with insolvency, unable to scale or compete with established OEMs. What’s left is a new survival rule: either plug into legacy automakers or perish. For tech firms entering auto, that means choosing licensing deals over autonomy, and partnerships over purity.

Apple’s Failure Was Inevitable

Apple’s car dreams collapsed for the same reason Microsoft’s Zune failed against the iPod—hubris. The company assumed its brand and engineering prowess could conquer a century of automotive expertise.

The future belongs to hybrid models like Sony-Honda—where tech firms enhance cars rather than build them.

For Apple, that means focusing on CarPlay 2.0 (its next-gen vehicle OS - CarPlay Ultra) instead of chasing an impossible hardware dream.

For the rest of Silicon Valley? A much-needed reality check.