The automotive world buzzed when Mary Barra, ever the master of strategic ambiguity, fielded a question about "new mobility collaborations" during GM's Q1 2025 earnings call. Her response—"We're open to partnerships that amplify our scale"—sounded innocuous enough.

But to those familiar with the lexicon of failed automotive deals, the phrasing carried unmistakable echoes of GM's abandoned negotiations with Apple over its secretive "Project Titan" electric vehicle program. This wasn't just corporate déjà vu.

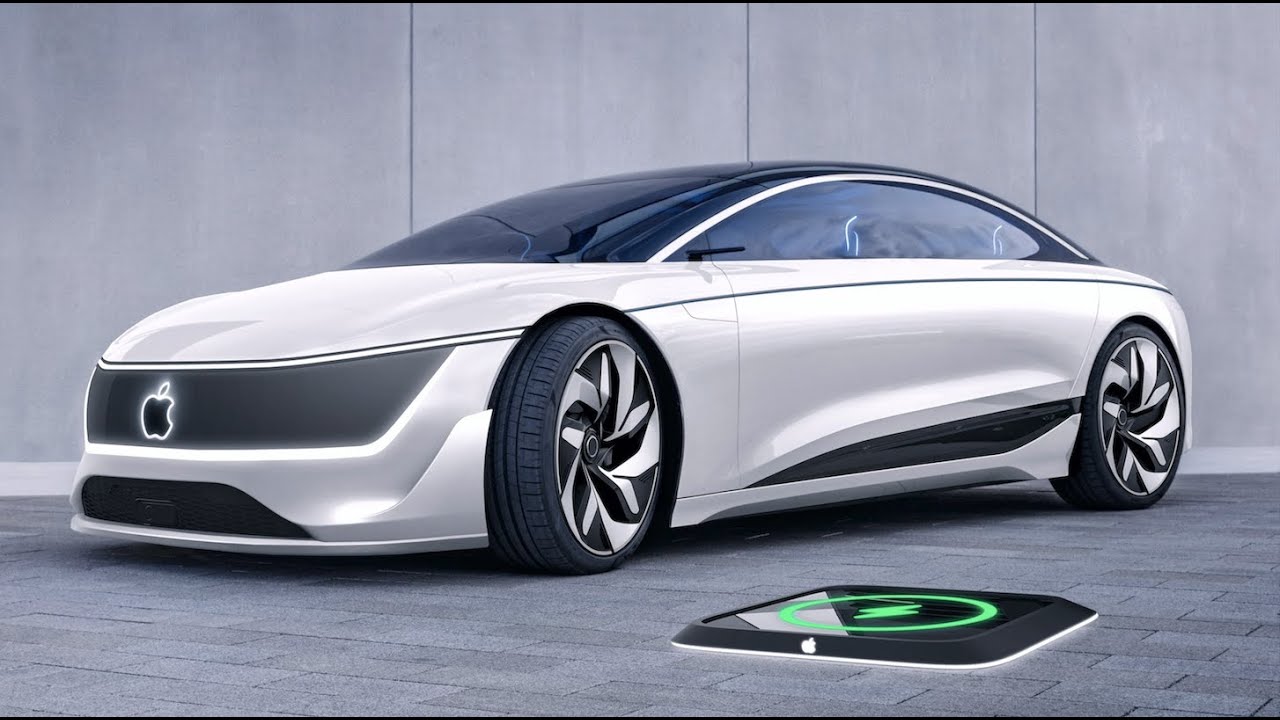

Multiple industry sources suggest that behind the scenes, GM and Apple have quietly resumed talks—though this time, the discussions center not on building an Apple-branded car, but on creating something potentially more disruptive: a next-generation autonomous mobility ecosystem that could leverage GM's Ultium battery technology and Cruise automation platform with Apple's legendary user experience and silicon expertise.

See also:

The Evolution Of A Failed Courtship

The original GM-Apple talks collapsed in early 2023 over what insiders describe as a "culture clash of biblical proportions." Recall that GM made the controversial decision to drop Apple CarPlay and Android Auto from its future EVs in 2023, opting instead for a Google-powered infotainment system.

Additionally, GM faced internal challenges in its software division, including the departure of a former senior Apple manager, Mike Abbott, in March 2024.

Apple's design team demanded near-impossible tolerances for panel gaps, while GM's engineers balked at the tech giant's expectation of Tesla-like software update capabilities without sharing critical vehicle data. But the landscape has shifted dramatically in two years.

Apple, facing developmental roadblocks and cooling investor enthusiasm for its automotive ambitions, has significantly scaled back Project Titan. The company's current focus—confirmed through job postings and supply chain leaks—has pivoted toward autonomous systems rather than full vehicle production.

Meanwhile, GM finds itself sitting on two assets that suddenly look very attractive to a tech partner: its modular Ultium battery system (which CEO Barra has explicitly mentioned licensing to other automakers) and Cruise's hard-won autonomous driving experience (despite its recent setbacks).

The New Calculus

Industry analysts see three potential scenarios emerging from renewed discussions:

The "Intel Inside" Model:

GM could become the anonymous manufacturer behind an Apple-designed autonomous vehicle, similar to how Foxconn builds iPhones. This would allow Apple to focus on user experience while leveraging GM's manufacturing scale—a concept hinted at by Barra's recent comments about "asset-light partnerships."

The Platform Play:

More likely, Apple might license GM's Ultium platform and Cruise autonomy stack as the foundation for its mobility ecosystem. Imagine Apple CarPlay evolving into "Apple Drive"—a full-stack autonomous experience powered by GM hardware but bearing Apple's branding and interface.

The Joint Venture Wildcard:

The most ambitious possibility would see the companies create a new entity—perhaps reviving the "iCar" trademark Apple quietly renewed last year—combining GM's manufacturing and regulatory expertise with Apple's design and silicon capabilities.

See also:

Why now?

The timing aligns with both companies' strategic needs. GM, having scaled back its own autonomous ambitions after Cruise's high-profile failures, could use Apple's brand halo and software prowess to regain momentum.

Apple, facing skepticism about its automotive capabilities, could piggyback on GM's established safety certifications and production infrastructure. Moreover, the regulatory environment has turned favorable.

Recent NHTSA rule changes have created clearer pathways for autonomous vehicles, while the Biden administration's clean manufacturing incentives make a U.S.-based production partnership financially attractive. Should this partnership materialize, the ripple effects would be immediate.

Ford would face intensified pressure in the commercial mobility space where it's betting heavily on its BlueCruise system. Tesla might finally encounter a user experience rival capable of matching its tech-centric appeal.

And traditional suppliers from Magna to Bosch would need to reassess their positions in an ecosystem where Silicon Valley and Detroit collaborate rather than compete.

The Skeptics' Case

Not everyone is convinced. "We've seen this movie before," cautions LMC Automotive analyst Michael Dean. "The auto and tech industries speak different languages, and joint projects tend to collapse under the weight of mutual misunderstanding."

Others point to Apple's notorious secrecy and control issues as ongoing obstacles. Yet the persistent whispers in both Detroit and Cupertino suggest something is brewing. When Barra speaks of "partnerships that amplify our scale," and Apple's latest job postings seek "automotive integration specialists with experience in high-volume manufacturing," the dots aren't difficult to connect.

As the auto industry enters its most disruptive decade, this may be the partnership that redefines mobility—if these two very different giants can finally make it work. The ghosts of past failures loom large, but the potential rewards might just be big enough to overcome them.